our Goals

our Goals

our Goals

Who We Are

Imagine financial experts who think differently, meeting your unique needs rather than quotas. This is exactly where Infiniti Wealth leads the charge. Serving organizations, companies, employees, and individuals, our flexible wealth services and insurance policies help customers make their money work harder. As an independent firm, we offer personalized services and planning to help our clients achieve their goals and cover them when the unexpected happens.

Who We Are

Imagine financial experts who think differently, meeting your unique needs rather than quotas. This is exactly where Infiniti Wealth leads the charge. Serving organizations, companies, employees, and individuals, our flexible wealth services and insurance policies help customers make their money work harder. As an independent firm, we offer personalized services and planning to help our clients achieve their goals and cover them when the unexpected happens.

Who We Are

Imagine financial experts who think differently, meeting your unique needs rather than quotas. This is exactly where Infiniti Wealth leads the charge. Serving organizations, companies, employees, and individuals, our flexible wealth services and insurance policies help customers make their money work harder. As an independent firm, we offer personalized services and planning to help our clients achieve their goals and cover them when the unexpected happens.

Who We Are

Imagine financial experts who think differently, meeting your unique needs rather than quotas. This is exactly where Infiniti Wealth leads the charge. Serving organizations, companies, employees, and individuals, our flexible wealth services and insurance policies help customers make their money work harder. As an independent firm, we offer personalized services and planning to help our clients achieve their goals and cover them when the unexpected happens.

Enhanced Insurance Policies With Your Best Interests in Mind

Insurance That Works For Life

Group Benefits

Coverage for Your Most Valuable Assets - Your Employees

Group benefits provides employers the opportunity to attract and retain loyal and talented employees. Infiniti Wealth offers group policies with valuable benefits, such as vision care, dental care, reduced premiums, and more.

Give your people the best gift possible: Added peace-of-mind with high-quality extended benefits tailored to their needs. Infiniti’s flexible plans combine some of Canada’s best group policies from top workplaces.

To help provide mental health support to individuals and families, Infiniti Wealth donates a portion of our proceeds to the CMHA.

Insurance

Insurance that Revolves Around You

While the idea of life and disability insurance may sound daunting, it's integral for the protection of your loved ones and overall financial plan. Infiniti Wealth offers affordable policies designed to protect clients from financial losses should they become disabled and unable to work.

Securing our custom insurance can help to streamline emergency situations, even when traveling - a benefit that can be potentially lifesaving. Infiniti’s personal health insurance can also cover costs pertaining to specialists if you sustain injuries in the future.

Wealth Management & Investments

At Infiniti Wealth, we never lose sight of the fact

that it’s your money

We provide you with expert guidance on risk management strategies to help make the most of your hard earned money and time.

Guard Your Money

We’re here to protect what’s yours. Experience the security and peace of mind that comes with a secure financial future. We are experts in risk management as well as wealth optimization to help you reach your goals without worry or stress.

We and our Investment Team Work Hard to Protect and Grow Your Money

We offer assistance with multiple savings instruments including the TFSA, RRSP, pensions, stocks, and more. In helping you to preserve and grow your wealth, we are determined to help you win.

Infiniti’s experts provide advanced guidance to identify, assess and manage the financial risks of high-net-worth individuals, including professional athletes. To help close any planning gaps, we deploy every phase of our high-net-worth blueprint for a solution that’s as unique as your very own fingerprint. Here’s how it works (please refer to the slideshow below).

Phase 1

Gain Clarity

Identify and Consider the Problem

We help you think clearly and confidently. This process of discovery generates clarity regarding your greatest risks and opportunities.

Phase 2

Make Decisions

Think About the Solution

We help you evaluate and decide which strategies can effectively eliminate any risks and instead, capture opportunities. As a result you can make decisions, leading to creative solutions.

Phase 3

Get Results

Implement the Solution

We focus on the implementation of your chosen solution to catalyze results. Your objective is to achieve your desired results.

Phase 4

Build Confidence

Manage Your Results

We focus on managing your results so they’re maintained over time. This phase provides long-term continuity and confidence.

Infiniti Wealth is a proud partner of the CMHA.

Enhanced Insurance Policies With Your Best Interests in Mind

Insurance That Works For Life

Group Benefits

Coverage for Your Most Valuable Assets - Your Employees

Group benefits provides employers the opportunity to attract and retain loyal and talented employees. Infiniti Wealth offers group policies with valuable benefits, such as vision care, dental care, reduced premiums, and more.

Give your people the best gift possible: Added peace-of-mind with high-quality extended benefits tailored to their needs. Infiniti’s flexible plans combine some of Canada’s best group policies from top workplaces.

To help provide mental health support to individuals and families, Infiniti Wealth donates a portion of our proceeds to the CMHA.

Insurance

Insurance that Revolves Around You

While the idea of life and disability insurance may sound daunting, it's integral for the protection of your loved ones and overall financial plan. Infiniti Wealth offers affordable policies designed to protect clients from financial losses should they become disabled and unable to work.

Securing our custom insurance can help to streamline emergency situations, even when traveling - a benefit that can be potentially lifesaving. Infiniti’s personal health insurance can also cover costs pertaining to specialists if you sustain injuries in the future.

Wealth Management & Investments

At Infiniti Wealth, we never lose sight of the fact

that it’s your money

We provide you with expert guidance on risk management strategies to help make the most of your hard earned money and time.

Guard Your Money

We’re here to protect what’s yours. Experience the security and peace of mind that comes with a secure financial future. We are experts in risk management as well as wealth optimization to help you reach your goals without worry or stress.

We and our Investment Team Work Hard to Protect and Grow Your Money

We offer assistance with multiple savings instruments including the TFSA, RRSP, pensions, stocks, and more. In helping you to preserve and grow your wealth, we are determined to help you win.

Infiniti’s experts provide advanced guidance to identify, assess and manage the financial risks of high-net-worth individuals, including professional athletes. To help close any planning gaps, we deploy every phase of our high-net-worth blueprint for a solution that’s as unique as your very own fingerprint. Here’s how it works (please refer to the slideshow below).

Phase 1

Gain Clarity

Identify and Consider the Problem

We help you think clearly and confidently. This process of discovery generates clarity regarding your greatest risks and opportunities.

Phase 2

Make Decisions

Think About the Solution

We help you evaluate and decide which strategies can effectively eliminate any risks and instead, capture opportunities. As a result you can make decisions, leading to creative solutions.

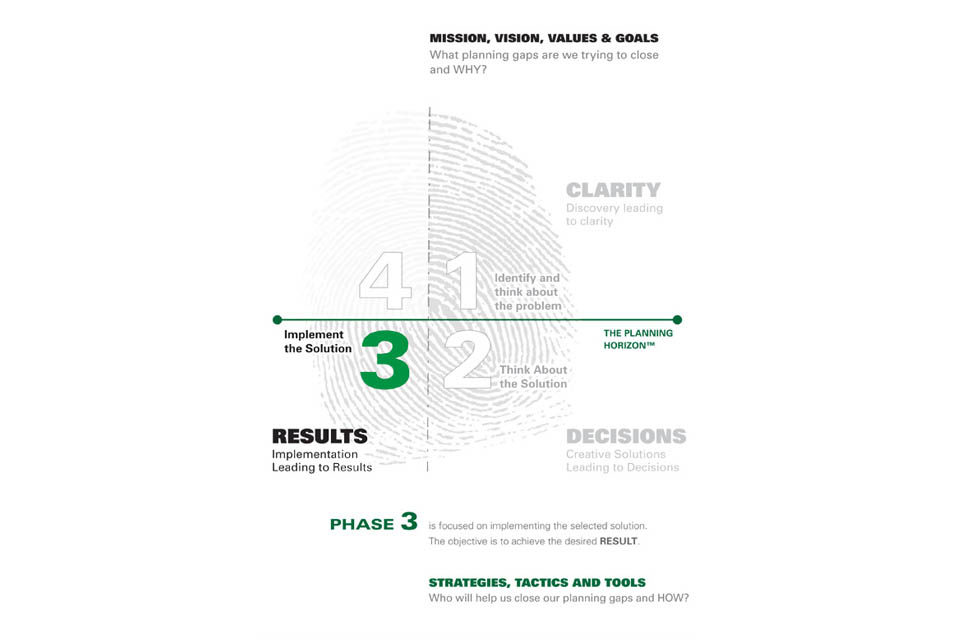

Phase 3

Get Results

Implement the Solution

We focus on the implementation of your chosen solution to catalyze results. Your objective is to achieve your desired results.

Phase 4

Build Confidence

Manage Your Results

We focus on managing your results so they’re maintained over time. This phase provides long-term continuity and confidence.

Infiniti Wealth is a proud partner of the CMHA.

Enhanced Insurance Policies With Your Best Interests in Mind

Insurance That Works For Life

Group Benefits

Coverage for Your Most Valuable Assets - Your Employees

Group benefits provides employers the opportunity to attract and retain loyal and talented employees. Infiniti Wealth offers group policies with valuable benefits, such as vision care, dental care, reduced premiums, and more.

Give your people the best gift possible: Added peace-of-mind with high-quality extended benefits tailored to their needs. Infiniti’s flexible plans combine some of Canada’s best group policies from top workplaces.

To help provide mental health support to individuals and families, Infiniti Wealth donates a portion of our proceeds to the CMHA.

Insurance

Insurance that Revolves Around You

While the idea of life and disability insurance may sound daunting, it's integral for the protection of your loved ones and overall financial plan. Infiniti Wealth offers affordable policies designed to protect clients from financial losses should they become disabled and unable to work.

Securing our custom insurance can help to streamline emergency situations, even when traveling - a benefit that can be potentially lifesaving. Infiniti’s personal health insurance can also cover costs pertaining to specialists if you sustain injuries in the future.

Wealth Management & Investments

At Infiniti Wealth, we never lose sight of the fact

that it’s your money

We provide you with expert guidance on risk management strategies to help make the most of your hard earned money and time.

Guard Your Money

We’re here to protect what’s yours. Experience the security and peace of mind that comes with a secure financial future. We are experts in risk management as well as wealth optimization to help you reach your goals without worry or stress.

We and our Investment Team Work Hard to Protect and Grow Your Money

We offer assistance with multiple savings instruments including the TFSA, RRSP, pensions, stocks, and more. In helping you to preserve and grow your wealth, we are determined to help you win.

Infiniti’s experts provide advanced guidance to identify, assess and manage the financial risks of high-net-worth individuals, including professional athletes. To help close any planning gaps, we deploy every phase of our high-net-worth blueprint for a solution that’s as unique as your very own fingerprint. Here’s how it works (please refer to the slideshow below).

Phase 1

Gain Clarity

Identify and Consider the Problem

We help you think clearly and confidently. This process of discovery generates clarity regarding your greatest risks and opportunities.

Phase 2

Make Decisions

Think About the Solution

We help you evaluate and decide which strategies can effectively eliminate any risks and instead, capture opportunities. As a result you can make decisions, leading to creative solutions.

Phase 3

Get Results

Implement the Solution

We focus on the implementation of your chosen solution to catalyze results. Your objective is to achieve your desired results.

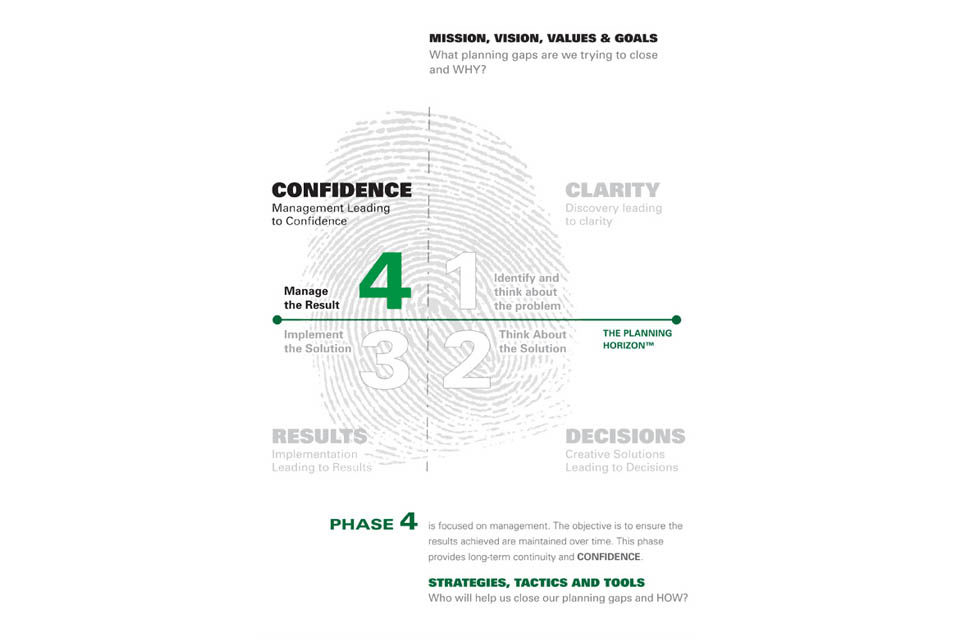

Phase 4

Build Confidence

Manage Your Results

We focus on managing your results so they’re maintained over time. This phase provides long-term continuity and confidence.

Infiniti Wealth is a proud partner of the CMHA.

Enhanced Insurance Policies With Your Best Interests in Mind

Insurance That Works For Life

Group Benefits

Coverage for Your Most Valuable Assets - Your Employees

Group benefits provides employers the opportunity to attract and retain loyal and talented employees. Infiniti Wealth offers group policies with valuable benefits, such as vision care, dental care, reduced premiums, and more.

Give your people the best gift possible: Added peace-of-mind with high-quality extended benefits tailored to their needs. Infiniti’s flexible plans combine some of Canada’s best group policies from top workplaces.

To help provide mental health support to individuals and families, Infiniti Wealth donates a portion of our proceeds to the CMHA.

Insurance

Insurance that Revolves Around You

While the idea of life and disability insurance may sound daunting, it's integral for the protection of your loved ones and overall financial plan. Infiniti Wealth offers affordable policies designed to protect clients from financial losses should they become disabled and unable to work.

Securing our custom insurance can help to streamline emergency situations, even when traveling - a benefit that can be potentially lifesaving. Infiniti’s personal health insurance can also cover costs pertaining to specialists if you sustain injuries in the future.

Contact us

Wealth Management & Investments

At Infiniti Wealth, we never lose sight of the fact that it’s your money

We provide you with expert guidance on risk management strategies to help make the most of your hard earned money and time.

Guard Your Money

We’re here to protect what’s yours. Experience the security and peace of mind that comes with a secure financial future. We are experts in risk management as well as wealth optimization to help you reach your goals without worry or stress.

We and our Investment Team Work Hard to Protect and Grow Your Money

We offer assistance with multiple savings instruments including the TFSA, RRSP, pensions, stocks, and more. In helping you to preserve and grow your wealth, we are determined to help you win.

Contact us

High-Net-Worth Individuals

Invest in Yourself

Infiniti’s experts provide advanced guidance to identify, assess and manage the financial risks of high-net-worth individuals, including professional athletes. To help close any planning gaps, we deploy every phase of our high-net-worth blueprint for a solution that’s as unique as your very own fingerprint. Here’s how it works (please refer to the slideshow below).

Contact usPhase 1

Gain Clarity

Identify and Consider the Problem

We help you think clearly and confidently. This process of discovery generates clarity regarding your greatest risks and opportunities.

Phase 2

Make Decisions

Think About the Solution

We help you evaluate and decide which strategies can effectively eliminate any risks and instead, capture opportunities. As a result you can make decisions, leading to creative solutions.

Phase 3

Get Results

Implement the Solution

We focus on the implementation of your chosen solution to catalyze results. Your objective is to achieve your desired results.

Phase 4

Build Confidence

Manage Your Results

We focus on managing your results so they’re maintained over time. This phase provides long-term continuity and confidence.

Infiniti Wealth is a proud partner of the CMHA.

Frequently Asked Questions

Select a question to reveal its answer

How many employees are required to qualify for group benefits?

We require just two employees.

What types of clients do you serve?

We provide insurance policies to companies, employees and individuals.

How is Infiniti Wealth different from other insurance companies?

Instead of setting goals to meet quotas, we focus on building long-term relationships. In this way, we are able to personalize a customer’s unique needs to their lifestyle or business.

Do I need to provide personal medical information to qualify for health insurance benefits?

In many cases, yes. In some cases, no. Sometimes, depending on the policy, you are guaranteed to receive coverage no matter what - which means no medical information is required. Talk to one of our insurance specialists for more information.

Frequently Asked Questions

Select a question to reveal its answer

How many employees are required to qualify for group benefits?

We require just two employees.

What types of clients do you serve?

We provide insurance policies to companies, employees and individuals.

How is Infiniti Wealth different from other insurance companies?

Instead of setting goals to meet quotas, we focus on building long-term relationships. In this way, we are able to personalize a customer’s unique needs to their lifestyle or business.

Do I need to provide personal medical information to qualify for health insurance benefits?

In many cases, yes. In some cases, no. Sometimes, depending on the policy, you are guaranteed to receive coverage no matter what - which means no medical information is required. Talk to one of our insurance specialists for more information.

Frequently Asked Questions

Select a question to reveal its answer

How many employees are required to qualify for group benefits?

We require just two employees.

What types of clients do you serve?

We provide insurance policies to companies, employees and individuals.

How is Infiniti Wealth different from other insurance companies?

Instead of setting goals to meet quotas, we focus on building long-term relationships. In this way, we are able to personalize a customer’s unique needs to their lifestyle or business.

Do I need to provide personal medical information to qualify for health insurance benefits?

In many cases, yes. In some cases, no. Sometimes, depending on the policy, you are guaranteed to receive coverage no matter what - which means no medical information is required. Talk to one of our insurance specialists for more information.

Frequently Asked Questions

Select a question to reveal its answer

How many employees are required to qualify for group benefits?

We require just two employees.

What types of clients do you serve?

We provide insurance policies to companies, employees and individuals.

What types of clients do you serve?

Instead of setting goals to meet quotas, we focus on building long-term relationships. In this way, we are able to personalize a customer’s unique needs to their lifestyle or business.

What types of clients do you serve?

In many cases, yes. In some cases, no. Sometimes, depending on the policy, you are guaranteed to receive coverage no matter what - which means no medical information is required. Talk to one of our insurance specialists for more information.

Reach Out

Infiniti Wealth Management Inc.

1508 W Broadway

Vancouver, BC V6J 1W8

Kash Chaudhri

Principal

604.742.2740

kash@infinitiwealth.com

Liam Howe

Partner

778.385.1992

liam.howe@infinitiwealth.com

Chelsey Tutte

Associate

604.329.0513

chelsey@infinitiwealth.com

Reach Out

Infiniti Wealth Management Inc.

1508 W Broadway

Vancouver, BC V6J 1W8

Kash Chaudhri

Principal

604.742.2740

kash@infinitiwealth.com

Liam Howe

Partner

778.385.1992

liam.howe@infinitiwealth.com

Chelsey Tutte

Associate

604.329.0513

chelsey@infinitiwealth.com

Kash Chaudhri

Principal

604.742.2740

kash@infinitiwealth.com

Liam Howe

Partner

778.385.1992

liam.howe@infinitiwealth.com

Chelsey Tutte

Associate

604.329.0513

chelsey@infinitiwealth.com

Reach Out

Kash Chaudhri

Principal

604.742.2740

kash@infinitiwealth.com

Liam Howe

Partner

778.385.1992

liam.howe@infinitiwealth.com

Chelsey Tutte

Associate

604.329.0513

chelsey@infinitiwealth.com